Mid-engine cars 2025: The best buys and biggest depreciation traps

3. The biggest depreciation traps

6. Conclusion

Mid-engine cars in 2025

Mid-engine cars are among the most thrilling machines you can own. But while they deliver unmatched driving excitement, not all of them make smart financial sense. Some models hold their value impressively, while others can turn into depreciation traps—costing you tens of thousands of euros in lost value.

In this article, we’ll explore the current state of the mid-engine car market in 2025, highlight which models are depreciating the fastest, and uncover which ones are proving to be surprisingly strong investments. By the end, you’ll know exactly which cars to avoid and which ones to keep an eye on if you’re a value-conscious buyer.

Market overview

The mid-engine market has been a rollercoaster since the pandemic. In 2023, depreciation rates spiked as the market corrected from its pandemic highs. On average, cars were losing around 12% per year, with some models falling as much as 16%.

By 2024, things had stabilized, and in 2025 the market strengthened dramatically. The average depreciation rate even turned positive: in September, mid-engine cars gained 0.9% on average, with individual models ranging between -2.9% and +2.4%.

However, averages can be deceiving. While the market looks flat overall, some models dropped as much as 20%. That’s why it’s crucial to look at individual cars before making a purchase.

The biggest depreciation traps

Ferrari 296

The quickest depreciating mid-engine model right now is the Ferrari 296. Coupés are down 19.6%, while Spiders lost 16.7%. Although the rate of decline seems to be slowing for higher-mileage examples, this Ferrari still represents a risky buy if you care about resale value.

Corvette Z06

The Corvette Z06 has also been hit hard, losing an average of 14.5%. Much of this is linked to inflated dealer premiums above MSRP, which have now corrected. Coupés are down 14% and Spiders 14.9%. While the worst may be behind us, depreciation still forms a major part of the ownership cost.

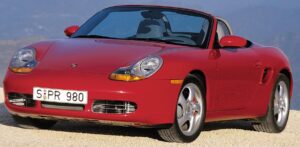

Porsche Boxster Spyder RS

With an MSRP of about €151,000 in 2024 (plus another 25% in options), the Spyder RS entered the market at high prices. Since then, values have dropped by 4.4% and continue to fall steadily.

Ferrari SF90

Hybrid Ferraris like the SF90 have been underperforming. Coupés and Spiders lost around 13% in 2024. While the decline is slowing, it’s still one of the weaker performers compared to models like the Ferrari 812 Superfast, which held value far better.

Maserati MC20

The MC20 was initially one of the fastest depreciating cars, losing up to 20% at its peak. In 2025, however, depreciation slowed to -7.3% on average. Coupés have been flat (down only 4.3%), while Spiders fell 10.2%. With supply dropping by 80%, this could actually be a buying opportunity.

Other notable decliners include the Lamborghini Huracán Sterrato, McLaren GT, Lotus Emira, BMW i8, and the Porsche Cayman/Boxster 718.

Cars that gained value

While some models are falling fast, others are bucking the trend and appreciating.

Ferrari Special Models

The Ferrari market is on fire. Cars like the 458 Speciale Coupé saw prices soar by over 50% in 2025—an unprecedented surge. This is even more extreme than the price spikes seen during the pandemic.

Porsche 981 Boxster S

The 981 Boxster S rose 9% in 2025. Prices had been flat for years but reversed strongly this year, with the gain statistically confirmed across the market.

McLaren LT Models

The 600LT, 675LT Coupé, and 765LT all appreciated between 6–9%, showing that limited-run, lightweight McLarens are holding strong against depreciation.

Porsche 986 Boxster S

Even entry-level mid-engine cars are joining the rally. The 986 Boxster S, one of the cheapest options, increased by 7.9%, mainly among low-mileage examples.

Lamborghini Aventador SVJ

Among Lamborghinis, the Aventador SVJ stood out with significant gains, confirming the model’s status as a collectible modern classic.

Alfa Romeo 4C

The Alfa Romeo 4C is another surprise winner. Prices gained 5.1% in 2025, making it one of the more affordable appreciating mid-engine cars compared to Ferraris or Lamborghinis.

The middle ground

Most cars fall somewhere between these extremes. Models like the Ferrari 812 Superfast, McLaren 720S, Porsche Cayman GTS, and even the Honda NSX have neither plummeted nor surged, offering steady but unspectacular value retention.

For buyers who care less about maximizing resale and more about balanced ownership costs, these models might strike the right compromise.

Conclusion

-

Avoid: Ferrari 296, Corvette Z06, SF90, Boxster Spyder RS — unless you’re willing to absorb steep depreciation.

-

Consider: Maserati MC20, Huracán Sterrato, McLaren GT — depreciation is slowing, which may create good entry points.

-

Strong Buys: Ferrari Speciale models, Porsche 981 Boxster S, McLaren LT cars, Alfa Romeo 4C, Aventador SVJ — these have proven to be value-positive in 2025.

Remember: all these numbers are based on the U.S. market and haven’t been adjusted for inflation. Past depreciation is a strong short-term indicator, but not a perfect predictor of long-term value.

If you’ve been waiting for the right moment to jump into the mid-engine market, 2025 offers both traps and opportunities. The key is to know which side your dream car falls on.

Inspired by the analysis of our friend @fourwheeltrader. Make sure you check his other videos https://www.youtube.com/@fourwheeltrader/featured.

Are you already a proud owner of a Ferrari, Corvette, Porsche Boxster, Maserati, Lamborghini and Alfa-Romeo? If so, check out our selection of parts for this car at the following link:

https://octoclassic.com/product-category/ferrari

https://octoclassic.com/product-category/chevrolet/corvette

https://octoclassic.com/product-category/porsche/boxster

https://octoclassic.com/product-category/maserati

https://octoclassic.com/product-category/lamborghini

https://octoclassic.com/product-category/alfa-romeo

Photos sources: cargurus.com, benlevy.com, jamesjnunez.pages.dev, Pinterest, MOTOR1, mrsportscars.com, hotcars.com